CALL NOW: 020 8673 7727

What is Ledger Accounts in Accounting Format, Types, Examples

Every financial transaction involves two sides, one account gets debited, and another is credited. This double-entry system ensures that the accounting equation remains balanced. A ledger serves as a central document for all financial transactions. You can use it to keep track of your spending and revenue by reporting expenses and income. You can also use the general ledger to compile a trial balance and spot unusual transactions, and help in creating financial statements.

Information is stored in a ledger account with beginning and ending balances, which are adjusted during an accounting period with debits and credits. Individual transactions are identified within a ledger account with a transaction number or other notation, so that one can research the reason why a transaction was entered into a ledger account. Transactions may be caused by normal business activity, such as billing customers or recording supplier invoices, or they may involve adjusting entries, which call for the use of journal entries. The totals calculated in the general ledger are then entered into other key financial reports, notably the balance sheet — sometimes called the statement of financial position. The balance sheet records assets and liabilities, as well as the income statement, which shows revenues and expenses. A general ledger (GL) is a set of numbered accounts a business uses to keep track of its financial transactions and to prepare financial reports.

AccountingTools

Each account maintains details of every transaction to its respective categories. Then, each account presents trial balances used to summarize each account balance. Some general ledger accounts can become summary records and will be referred to as control accounts.

- Similarly, it is a central repository where all the individual accounts are maintained.

- The transactions are then closed out or summarized in the general ledger, and the accountant generates a trial balance, which serves as a report of each ledger account’s balance.

- Owner’s equity accounts are accounts that show how much money company owners and investors have invested in the company.

- Transactions are posted to individual sub-ledger accounts, as defined by the company’s chart of accounts.

- Make columns on the right side for debits, credits, and running balance.

At the same time, accountants must ensure that the number of debits matches the number of credits under double-entry accounting standards. Previously, business owners would use general ledgers to double-check mistakes and errors to free paycheck calculator produce accurate financial statements. These days, accounting software does this automatically with your journal ledger. The chart of accounts is broken down into asset, liability, owner’s equity, revenue and expense accounts.

Importance of the General Ledger in Accounting

Preparing a ledger is important as it serves as a master document for all your financial transactions. The general ledger also helps you compile a trial balance, spot unusual transactions, and create financial statements. A general ledger is the foundation of a system employed by accountants to store and organize financial data used to create the firm’s financial statements. Transactions are posted to individual sub-ledger accounts, as defined by the company’s chart of accounts. Every business needs to use ledgers to meet the standards of double-entry bookkeeping and accounting. If managing credits, debits, and trial balances isn’t your thing, why not call in the experts?

Journalizing is the process of recording transactions in a journal as journal entries. Posting is the process of transferring the all the transactions to the ledger. Check out the post “Maintaining a General Ledger” from Wolters Kluwer for a more extensive list of general ledger accounts that might apply to medium to large businesses. The income statement follows its own formula, which works as follows. When a company receives payment from a client for the sale of a product, the cash received is tabulated in net sales along with the receipts from other sales and returns. The cost of sales is subtracted from that sum to yield the gross profit for that reporting period.

What is Anti-Money Laundering (AML)? – Techopedia

What is Anti-Money Laundering (AML)?.

Posted: Tue, 29 Aug 2023 07:57:47 GMT [source]

The net result is that both the increase and the decrease only affect one side of the accounting equation. For example, a manufacturer would have raw materials inventory, work in process inventory, and finished inventory accounts in its asset section. A retailer, on the other hand, might have an account for promotional inventory or merchandise not for sale. Many retailers also create different accounts for new promotions and specific inventory classes. To maintain the accounting equation’s net-zero difference, one asset account must increase while another decreases by the same amount.

Types of Ledger Accounts

Each type of business transaction can be categorized as a new type. A ledger account is the record of transactions related to a particular segment of the business. The transactions in a general ledger are organized into five main types; assets, liabilities, equity, revenue, and expenses. A general ledger is used in businesses that sell services or products. It’s considered to be the heart of all their business transactions since it provides users with the ability to gather information on sales, purchases, and cash flow.

This helps give insight into how much profit or loss is being made within a certain time period. Ledgers also provide the ability to enter financial transactions so that they may be posted up into various accounts. An accounting ledger refers to a financial record book where accounting transactions are recorded.

Basic General Ledger Example

However, the trial balance does not serve as proof that the other records are free of errors. For example, if journal entries for a debit and its corresponding credit were never recorded, the totals in the trial balance would still match and not suggest an error. So, it can be said that the book wherein various entries of the journal are posted in brief permanently according to debit and credit under separate heads of accounts is called ledger. Keep in mind that this is just a general list, and companies may have more specific account codes depending on their industry or accounting practices. It’s important to establish a clear and organized chart of accounts to ensure consistency and accuracy in financial reporting.

It provides details of the item, the amount sold, the date of transaction, whether in credit or cash and the sale value. To know all this information the transactions of the same nature are to be recorded under different heads or in separate accounts. Ledger accounts present comprehensive accounting records of the business. These accounts are also used for accounting reconciliation purposes.

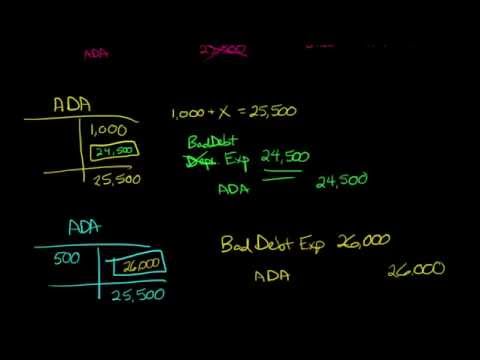

Debit/credit

It’s the core of double-entry accounting and is used by every business today. The general ledger is essential for ensuring that credits and debits balance, so businesses are properly informed about the state of their finances. The account balances inside the journal ledger may be used to calculate a trial balance.

Accounting’s fundamentals are journal entries, and a general ledger is the skilful arrangement and presentation of journal entries. General ledgers help organise accounting and make it easier to prepare trial balances, which help prepare financial statements. Companies that employ double-entry bookkeeping for recording transactions can create an accounting ledger. Every transaction is recorded in at least two of the accounts, including debit and credit transactions with two columns. Balancing the general ledger is a critical part of the accounting process, as it ensures the accuracy of financial statements and allows companies to make informed decisions based on their financial data.

Balance Sheet and Income Statement Ledger Accounts

Ledger accounts then combined make up the general ledger of the business. These accounts and the general ledger form the basis of financial statements for any business. This will be helpful when it comes time to prepare reports such as cash flow statements and balance sheets which require users to provide information on their expenses. Financial transactions posted into the ledger are broken down by type into specific accounts whether they are classified as assets, liabilities, equity, expenses, and revenues.

Posted by adwords on 3rd August 2021, under Bookkeeping

Dr. Kishanie Wijesinghe Little BDS

Dr. Kishanie Wijesinghe Little BDSDr. Kishanie Little is passionate about delivering excellent dentistry and dental restorations that are life-like and indistinguishable from natural teeth. She believes that restorations (fillings/crowns/veneers) should look beautiful – and that they should last. Dr. Little keeps abreast of new developments in restorative dentistry through post-graduate training.

Dr. Little is also an experienced Facial Aesthetistician, including Botulinum toxins (such as Botox) and Dermafillers. She appreciates how simple and subtle changes to smooth and relax muscles can “freshen” a face, to look younger.

In her personal time, she loves to cook, read, run, practice yoga and pilates, play a bad game of tennis and am now learning to play golf. She loves Art and Theatre and support the Tate Modern. She also enjoys writing and has a book in the works.