CALL NOW: 020 8673 7727

Financial Ratios For Ratio Analysis Examples Formulas

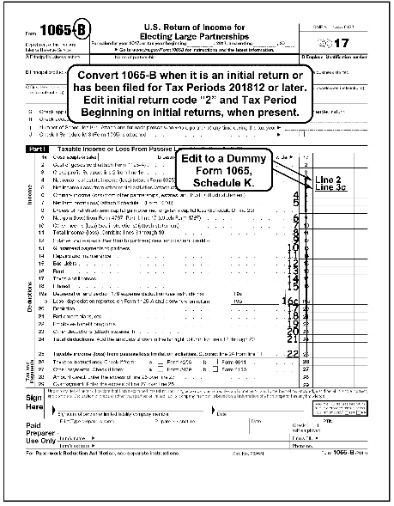

For instance, the debt-to-equity ratio describes the connection between the firm’s debt and equity, which is available on its balance sheet. Learning ratio analysis types can simplify your understanding of how to calculate and interpret various ratios. Ratio analysis is a quantitative process that uses comparison ratios to determine the financial well-being of a business. how to pay your taxes Using ratio analysis, we can learn more about a company’s liquidity, profitability, efficiency, and solvency by looking at its essential financial measures. Ratio analysis is a financial process that informs the management and investors of a company about the company’s financial status. It is typically denoted as a percentage and can be a marker of the growth of a company.

Target trial emulation with multi-state model analysis to assess … – BMC Medical Research Methodology

Target trial emulation with multi-state model analysis to assess ….

Posted: Sat, 02 Sep 2023 07:49:28 GMT [source]

Parametric tests offer a deeper level of insight than non-parametric tests. While you can still apply these to ratio data, they will not make the most of a ratio dataset’s full range of characteristics. The two main types of statistical analysis are descriptive and inferential statistics. Descriptive statistics summarize a dataset’s characteristics. Inferential statistics allow you to test hypotheses or make predictions.

We cannot compare companies enforcing differing concepts. Furthermore, every analyst has their technique to evaluate and interpret ratios and their knowledge of the subject. Seasonal effects can also result in inefficient analytical outcomes.

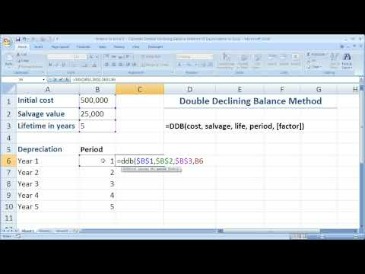

Financial Ratio Analysis Tutorial With Examples

High Cash Ratio

As Step-up Ltd. had a higher ratio than 0.5 in 2021, it could repay at least 0.51, i.e., 51% of its liabilities using cash and cash equivalents. However, it also means the company had a poor capital management system. High Quick Ratio

As Marks & Co. had a higher ratio than 1 (1.15) in 2021, it had enough liquid assets to fulfill its debt obligations. Low Current Ratio

As Starlane Ltd. had a ratio of 0.81 in 2021, which is lower than 1.2, it may have difficulty repaying its short-term debt obligations.

Using any ratio in any of the categories listed above should only be considered as a starting point. Further analysis using additional ratios and qualitative analysis should be incorporated to effectively analyze a company’s overall financial position. Although this article guides you through the meaning, purpose, and various types of ratio analysis, we also learn its advantages and disadvantages. To learn more about Ratio analysis, you can visit the following links.

Example: Debt-to-Assets

Let us determine the EPS ratio of Walt Disney Co for 2022. It means that for each $1 that investors invest in this company’s shares, they get a return of $2.48. Paypal Holdings’ had a profit-to-earning ratio of 53.57 in 2021. It shows that the share was overpriced, and the investors and shareholders paid higher value.

Starvation responses impact interaction dynamics of human gut … – Nature.com

Starvation responses impact interaction dynamics of human gut ….

Posted: Tue, 05 Sep 2023 10:52:46 GMT [source]

With a true zero in your scale, you can calculate ratios of values. For example, you can say that 4 children is twice as many as 2 children in a household. The ratio level is the highest of four hierarchical levels of measurement. The levels, or scales, of measurement indicate how precisely data is recorded. The higher the level, the more complex the measurement is.

The problem for this company, however, is that they have to sell inventory in order to pay their short-term liabilities and that is not a good position for any firm to be in. Solvency ratios measure a company’s long-term financial viability. These ratios compare the debt levels of a company to its assets, equity, or annual earnings. Liquidity ratios measure a company’s ability to meet its debt obligations using its current assets. When a company is experiencing financial difficulties and is unable to pay its debts, it can convert its assets into cash and use the money to settle any pending debts with more ease. The management of a company can also use financial ratio analysis to determine the degree of efficiency in the management of assets and liabilities.

Efficiency Ratios

Cash Ratio of Paypal Holdings

Let us determine the cash ratio of Paypal Holdings for 2021. We get the following financials from Paypal’s annual report. This ratio helps businesses ascertain information about the capability of a company to pay off its current liabilities on an immediate basis. High Current Ratio

Starlane Ltd. had a ratio of 1.32 in 2022, which is higher than 1.2, indicating that the company is highly capable of repaying its short-term debt obligations.

Certain ratios are closely scrutinized because of their relevance to a certain sector, such as inventory turnover for the retail sector and days sales outstanding (DSOs) for technology companies. The implementation of accounting policies differs from industry to industry. However, sometimes within the same industry, various companies follow individual accounting policies.

Market Value Ratios

Any person or a firm can buy or sell an asset without any drastic change in the asset’s price. Therefore liquidity ratio uses ratio analysis equations to help us to determine the short-term liquidity of a firm. A creditor wants to decide between companies A and B to make a debt obligation.

Analysts also use ratios like current ratio, ROI, debt to equity, P/E, etc., to perform business analysis. The use of ratio analysis can be misleading when comparing the results of businesses across industries. This means that a utility is more likely to incur debt in order to pay for its fixed assets, while a software company may incur no debt at all. Profitability ratios are a set of measurements used to determine the ability of a business to create earnings. Profitability ratios are derived from a comparison of revenues to difference groupings of expenses within the income statement.

- They are nominal data, ordinal data, ratio data, and interval data.

- A company with a very low profit margin may need to focus on decreasing expenses through wide-scale strategic initiatives.

- This comparison plays a vital role in the business planning process.

- A smaller percentage is better because it means that a company carries less debt compared to its total assets.

- Successful companies generally have solid ratios in all areas, and any hints of weakness in one area may spark a significant sell-off of the stock.

- It represents the operating profits of an organization after making necessary adjustments to the COGS or cost of goods sold.

They give investors an idea of a company’s financial health as it relates to a potential burden of debt. Liquidity ratios give investors an idea of a company’s operational efficiency. They also show how quickly and easily a company can generate cash to purchase additional assets or to repay creditors.

Liquidity Ratios

It can help us ascertain the organization’s profits and financial ability to repay all short-term and long-term debt obligations. Net profit ratios determine the overall profitability of an organization after reducing both cash and non-cash expenditures. An excellent net profit should be equal to or higher than 10%.

- High Operating Profit Ratio

Globex Corp. had a higher ratio than 10% in 2021, indicating higher profitability and 18.5% of its total revenue is its operating profit. - Lack of practice can cause a student to forget the basic concepts of this topic.

- Let us determine the fixed assets turnover ratio of Apple Inc for 2022.

- Financial ratios are mathematical comparisons of financial statement accounts or categories.

- Bear in mind, the company can still have problems even if this is the case.

- A company can track its inventory turnover over a full calendar year to see how quickly it converted goods to cash each month.

That means that you can only calculate ratios of temperatures in the Kelvin scale. Although 40° is twice as many degrees as 20°, it isn’t twice as hot on the Celsius or Fahrenheit scales. However, in the Kelvin scale, 40 K is twice as hot as 20 K because there is a true zero at the starting point of this scale.

Their annual net income is $550,000 and $490,000, respectively. Therefore, perform ratio analysis by calculating the P/E ratio. The current ratio of Company A is higher than Company B, meaning it is comparatively more liquid. Thus, Company A will be more beneficial for the creditor.

Fortunately, the company’s net profit margin is increasing because their sales are increasing. We don’t know if this is good or bad since we do not know the debt-to-asset ratio for firms in this company’s industry. However, we do know that the company has a problem with its fixed asset ratio which may be affecting the debt-to-asset ratio. Here are a few of the most important financial ratios for business owners to learn, what they tell you about the company’s financial statements, and how to use them. While it may be more fun to work on marketing efforts, the financial management of a firm is a crucial aspect of owning a business.

Posted by adwords on 7th December 2020, under Bookkeeping

Dr. Kishanie Wijesinghe Little BDS

Dr. Kishanie Wijesinghe Little BDSDr. Kishanie Little is passionate about delivering excellent dentistry and dental restorations that are life-like and indistinguishable from natural teeth. She believes that restorations (fillings/crowns/veneers) should look beautiful – and that they should last. Dr. Little keeps abreast of new developments in restorative dentistry through post-graduate training.

Dr. Little is also an experienced Facial Aesthetistician, including Botulinum toxins (such as Botox) and Dermafillers. She appreciates how simple and subtle changes to smooth and relax muscles can “freshen” a face, to look younger.

In her personal time, she loves to cook, read, run, practice yoga and pilates, play a bad game of tennis and am now learning to play golf. She loves Art and Theatre and support the Tate Modern. She also enjoys writing and has a book in the works.