CALL NOW: 020 8673 7727

AI in Finance: 10 Use Cases That Will Become More Common in 2023 The AI-powered spend management suite

Credit card companies can use ML technology to predict at-risk customers and specifically retain selected ones out of these. Based on user demographic data and transaction activity, they can easily predict user behavior and design offers specifically for these customers. The massive volume and structural diversity of financial data from mobile communications, social media activity to transactional details, and market data make it a big challenge even for financial specialists to process it manually. With NVIDIA’s AI platform, financial institutions can harness the power of AI and HPC to learn from vast amounts of data and respond quickly to market fluctuations. This is, of course, thanks to the ability of these chatbots to handle customer inquiries around the clock, reducing the need for human customer service representatives and allowing financial institutions to operate more efficiently. As previously explained, OCR can read the text on the invoice and identify the relevant fields, such as the invoice number and supplier name.

In this free self-paced course, get hands-on experience developing and deploying the NVIDIA Morpheus digital fingerprinting AI workflow, which enables 100% data visibility and drastically reduces the time to detect threats. Unlike traditional methods, in which a breach is reported only after a crime has occurred, AI may prevent fraud by continuously monitoring and comprehending data patterns based on human psychology. Forward-thinking industry leaders look to robotic process automation when they want to cut operational costs and boost productivity. For example, in the traveling industry, Artificial Intelligence helps to optimize sales and price, as well as prevent fraudulent transactions. Also, AI makes it possible to provide personalized suggestions for desired dates, routes, and costs, when we are surfing airplane or hotel booking sites planning our next summer vacation. By assigning such tasks to machines, finance teams can focus on areas of growth and respond faster to changes in the market.

Invoice processing automation with AI

In addition, the use of algorithms in trading can also make collusive outcomes easier to sustain and more likely to be observed in digital markets (OECD, 2017[16]). AI-driven systems may exacerbate illegal practices aiming to manipulate the markets, such as ‘spoofing’6, by making it more difficult for supervisors to identify such practices if collusion among machines is in place. It should be noted that the massive take-up of third-party or outsourced AI models or datasets by traders could benefit consumers by reducing available arbitrage opportunities, driving down margins and reducing bid-ask spreads. At the same time, the use of the same or similar standardised models by a large number of traders could lead to convergence in strategies and could contribute to amplification of stress in the markets, as discussed above.

- Receipt Cat is an AI-powered tool that helps small businesses and independent developers manage thei..

- Potential consequences of the use of AI in trading are also observed in the competition field (see Chapter 4).

- Less than 70 years from the day when the very term Artificial Intelligence came into existence, it’s become an integral part of the most demanding and fast-paced industries.

- Leading finance organizations are already using AI and ML technologies in Workday to help deliver better employee experiences, improve operational efficiencies, and provide insights for faster data-driven decision-making.

AI models and techniques are being commoditised through cloud adoption, and the risk of dependency on providers of outsourced solutions raises new challenges for competitive dynamics and potential oligopolistic market structures in such services. The opacity of algorithm-based systems could be addressed through transparency requirements, ensuring that clear information is provided as to the AI system’s capabilities and limitations (European Commission, 2020[43]). Separate disclosure should inform consumers about the use of AI system in the delivery of a product and their interaction with an AI system instead of a human being (e.g. robo-advisors), to allow customers to make conscious choices among competing products. Suitability requirements, such as the ones applicable to the sale of investment products, might help firms better assess whether the prospective clients have a solid understanding of how the use of AI affects the delivery of the product/service.

Create your account, save tools & stay updated

For Chase, consumer banking represents over 50% of its net income; as such, the bank has adopted key fraud detecting applications for its account holders. Chase’s high scores in both Security and Reliability—largely bolstered by its use of AI—earned it second place in Insider Intelligence’s 2020 US Banking Digital Trust survey. Consumers are hungry for financial independence, and providing the ability to manage one’s financial health is the driving force behind adoption of AI in personal finance. Whether offering 24/7 financial guidance via chatbots powered by natural language processing or personalizing insights for wealth management solutions, AI is a necessity for any financial institution looking to be a top player in the industry. The decision for financial institutions (FIs) to adopt AI will be accelerated by technological advancement, increased user acceptance, and shifting regulatory frameworks.

- AI technology is incredibly versatile and can be used in various applications, including chatbots, predictive analytics, natural language processing, and image recognition, among others.

- Companies will often describe their products as “AI-powered” without a clear explanation of what that means.

- Reduce days sales outstanding, lower total cost of ownership with improved efficiencies and enhance quality of work related to accounts receivables with intelligent invoice matching automation.

- Regulatory sandboxes specifically targeting AI applications could be a way to understand some of these potential incompatibilities, as was the case in Colombia.

Financial institutions worldwide are applying AI algorithms with important business benefits and the emergence of tech-savvy customers. Digital banks and loan-issuing apps use machine learning algorithms to use alternative data (e.g., smartphone data) to evaluate loan eligibility and provide personalized options. Artificial Intelligence provides a faster, more accurate assessment of a potential borrower, at less cost, and accounts for a wider variety of factors, which leads to a better-informed, data-backed decision.

Given that code is the underlying basis of any smart contract, flawless coding is fundamental for the robustness of smart contracts. AI techniques could further strengthen the ability of BigTech to provide novel and customised services, reinforcing their competitive advantage over traditional financial services firms and potentially allowing BigTech to dominate in certain parts of the market. The data advantage of BigTech could in theory allow them to build monopolistic positions, both in relation to client acquisition (for example through effective price discrimination) and through the introduction of high barriers to entry for smaller players. Strategies based on deep neural networks can provide the best order placement and execution style that can minimise market impact (JPMorgan, 2019[8]). Deep neural networks mimic the human brain through a set of algorithms designed to recognise patterns, and are less dependent on human intervention to function and learn (IBM, 2020[9]).

Key financial consumer protection policy responses relating to selected Principles

In certain jurisdictions, such as Poland, information should also be provided to the applicant on measures that the applicant can take to improve their creditworthiness. Skills and technical expertise becomes increasingly important for regulators and supervisors who need to keep pace with the technology and enhance the skills necessary to effectively supervise AI-based applications in finance. Enforcement authorities need to be technically capable of inspecting AI-based systems and empowered to intervene when required (European Commission, 2020[43]).

And if artificial intelligence is, at its core, computer-generated prediction, then regressions, or statistical models that take in existing data to forecast trends, would be some of the first to be widely implemented in the financial industry, he said. Machine learning models can be of great help to finance companies when it comes to analyzing current market trends, predicting the changes, and social media usage for every customer. The future will see ML and AI technologies being actively used by insurance recommendation sites to suggest customers a particular home or vehicle insurance policy. Further, an interesting trend to watch in the future would be Robo-advisors suggesting changes in portfolios and a rapid rise of ML-based personalized apps and personal assistants offering more objective and reliable advisory services to the customers.

How Buhler Turbocharged their Spend Management with Yokoy

Fraud detection is one of the key areas where AI can provide significant support to finance departments. Artificial intelligence can be used to analyze large datasets and identify fraudulent activities – such as credit card fraud or money laundering – in real-time. OCR technology is a subset of AI and is used extensively in financial institutions to automate tasks such as document processing, data extraction, and fraud detection. However, increasing regulatory concerns, a current lack of explainability, and the existence of bias are challenges the industry must face before moving forward. The finance industry should weigh the risks before utilizing artificial intelligence – yet the potential benefits clearly make AI a worthwhile investment. While AI may enable financial institutions to provide better service and reduce manual tasks, there are still challenges we must meet head-on, including data privacy, bias and quality concerns.

Financial institutions can benefit from sentiment analysis to measure their brand reputation and customer satisfaction through social media posts, news articles, contact centre interactions or other sources. This automation not only streamlines the reporting process and reduces manual effort, but it also ensures consistency, accuracy, and timely delivery of reports. In this 10 Tips for Managing Small Business Finances article, we explain top generative AI finance use cases by providing real life examples. If your focus is just banking, a subset of these use cases are listed in generative AI use cases in banking. However, enterprise generative AI has unique challenges and finance executives are not aware of most generative AI applications in their industry which slows down adoption.

AI-powered computers can analyze large, complex data sets faster and more efficiently than humans. The resulting algorithmic trading processes automate trades and save valuable time. If there’s one technology paying dividends for the financial sector, it’s artificial intelligence. AI has given the world of banking and finance new ways to meet the customer demands of smarter, safer and more convenient ways to access, spend, save and invest money. By learning from historical financial data, generative AI models can capture complex patterns and relationships in the data, enabling them to make predictive analytics about future trends, asset prices, and economic indicators. Avanzai is an AI tool for accelerating financial data analysis using natural language input.

Reconcile is an end-to-end tax filing solution that allows tax payers to securely connect with over 9,000 banks and financial institutions.Its AI engine can intake information from various accounts su.. CoinFeeds is an AI-powered platform that consolidates information from various channels to provide crypto businesses and investors with enhanced decision-making power. – By 2025, 70% of organizations will use data-lineage-enabling technologies including graph analytics, ML, A.I., and blockchain as critical components of their semantic modeling. There’s been a lot of discussion on the use of artificial intelligence and the future of work. Models, which “generate” new content based on terabytes and terabytes of training data, can spread “personalization writ large” across finance.

The company offers solutions for safeguarding data, digital transformation, GRC and fraud management as well as open banking. Accelerating data analysis allows businesses to achieve results faster while being more cost-effective. Many financial institutions are turning to machine learning to boost fraud detection accuracy, reduce false positives, and improve compliance with AML and KYC regulations. Artificial intelligence in finance is a powerful ally in analyzing real-time activities in any given market or environment; the accurate predictions and detailed forecasts it provides are based on multiple variables and are vital to business planning.

The recent years have seen a rapid acceleration in the pace of disruptive technologies such as AI and ML in Finance due to improved software and hardware. The finance sector, specifically, has seen a steep rise in the use cases of machine learning applications to advance better outcomes for both consumers and businesses. To finance students and practitioners, this book will explain the promise of AI, as well as its limitations. It will cover knowledge representation, modelling, simulation and machine learning, explaining the principles of how they work. To computing students and practitioners, this book will introduce the financial applications in which AI has made an impact.

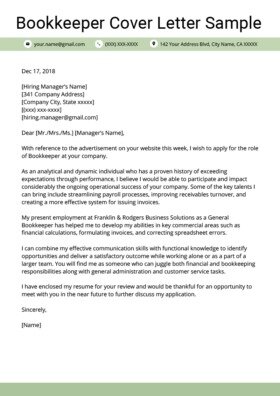

Posted by adwords on 17th March 2021, under Bookkeeping

Dr. Kishanie Wijesinghe Little BDS

Dr. Kishanie Wijesinghe Little BDSDr. Kishanie Little is passionate about delivering excellent dentistry and dental restorations that are life-like and indistinguishable from natural teeth. She believes that restorations (fillings/crowns/veneers) should look beautiful – and that they should last. Dr. Little keeps abreast of new developments in restorative dentistry through post-graduate training.

Dr. Little is also an experienced Facial Aesthetistician, including Botulinum toxins (such as Botox) and Dermafillers. She appreciates how simple and subtle changes to smooth and relax muscles can “freshen” a face, to look younger.

In her personal time, she loves to cook, read, run, practice yoga and pilates, play a bad game of tennis and am now learning to play golf. She loves Art and Theatre and support the Tate Modern. She also enjoys writing and has a book in the works.