CALL NOW: 020 8673 7727

Accounting For Startups: The Ultimate Guide In 2023

Content

A business bank account also simplifies your business administration and tax returns. Additionally, it shows professionalism when you’re transacting with clients and suppliers. Your accounting processes should start as soon as you launch your business. Keep in mind that your success is based on your profitability or bottom line.

With all the responsibilities you already have as a business owner, taking on these financial responsibilities may become overwhelming, especially if you have not overseen business finances before. When you’re setting up your business’ accounting, you should also research tax obligations to determine how your choices could impact you when taxes are due. For example, you may be responsible for paying sales and use taxes, and if you don’t, you could face penalties from the IRS. On the other hand, being familiar with small business taxes can also help you take advantage of certain tax credits and deductions, which can help save you money.

Cash basis accounting

Again, any accounting software application you purchase will have an invoicing component included, which means accounts receivable tracking as well. If you want to get paid, be sure that you’re regularly invoicing and following up on those invoices. If you don’t have any employees yet, you don’t have to worry about payroll.

- As long as all your transactions can be proven, you won’t have a problem filling your tax returns, and you may even be able to apply for tax relief.

- Selling to international customers can be easier than domestic sales.

- A bookkeeper isn’t someone who should take their job lightly, as much of a business boils down to the all-important element of finances.

- Even if you go with a sole proprietorship, you’ll still need to keep your personal and business finances separate.

- If the thought of doing your books is overwhelming, you have plenty of other options including enlisting the help of a CPA.

- It also makes running your business a lot easier because you are going to see what is going on all the time.

- Whatever the time stamp is on those transactions, that’s the month it’s accounted for.

- The Credit for Increasing Research Activities, more commonly known as the R&D tax credit, allows you to carry forward the value of the credit into your future, profitable years.

- There are many options for small business accounting software solutions, but ideally, you should choose a system that’s easy to use and intuitive.

Once your startup grows to this point, you must file your income taxes using this method even if you keep your books using the cash basis method. Remember, to get a small business loan, you’ll likely have to provide financial statements—a balance sheet and income statement at the very least, possibly a cash flow statement well. Shopify Capital makes it simple for Shopify merchants to secure funding.

Basic Accounting Processes And Tasks

If you don’t understand the variables that make up a financial forecast, you might not realize that there are other levers to pull to get the same results over time. That can lead to extra stress or bad decision making when a forecast proves incorrect, which it likely will. For instance, you might use an aggressive forecast when pitching your business to investors, modeling that it will take four engineers six months to build a feature. But you should also understand what your business would look like if it takes five engineers eight months to build the feature. So when he founded Pinger, a messaging startup, in 2005, one of Woock’s first steps was to work closely with a math whiz with deep knowledge of the telecommunications industry.

How do I set up accounting for my small business?

- Open a small business bank account.

- Track your small business expenses.

- Develop a bookkeeping system.

- Set up a small business payroll system.

- Investigate import tax.

- Determine how you'll get paid.

- Establish sales tax procedures.

- Determine your tax obligations.

Keep reading to learn more about accounting basics and how you can implement a useful accounting system for your startup. If you’d like to learn more about the basics of startup financing before launching your accounting services for startups business, visit our website and watch our webinars on this topic. Depending on the nature of the business, startups usually incorporate an S corporation, a limited liability company, or a sole proprietorship.

What is the Research and Development Tax Credit?

The main thing about payroll is, if you hire an employee, you need to calculate payroll correctly – not just randomly pay them an amount. Best practices will be to do journal entries yourself if cash is tight in an early startup. For newer teams, keeping business expenses low is the top priority. An income statement will show how profitable your business is over a reported period. It displays a startup’s revenue subtracted from their expenses and losses. The balance sheet statement shows everything that your business owns (assets), owes (liabilities), and the value of the business owner’s investments (owner’s equity).

Do startups need bookkeeping?

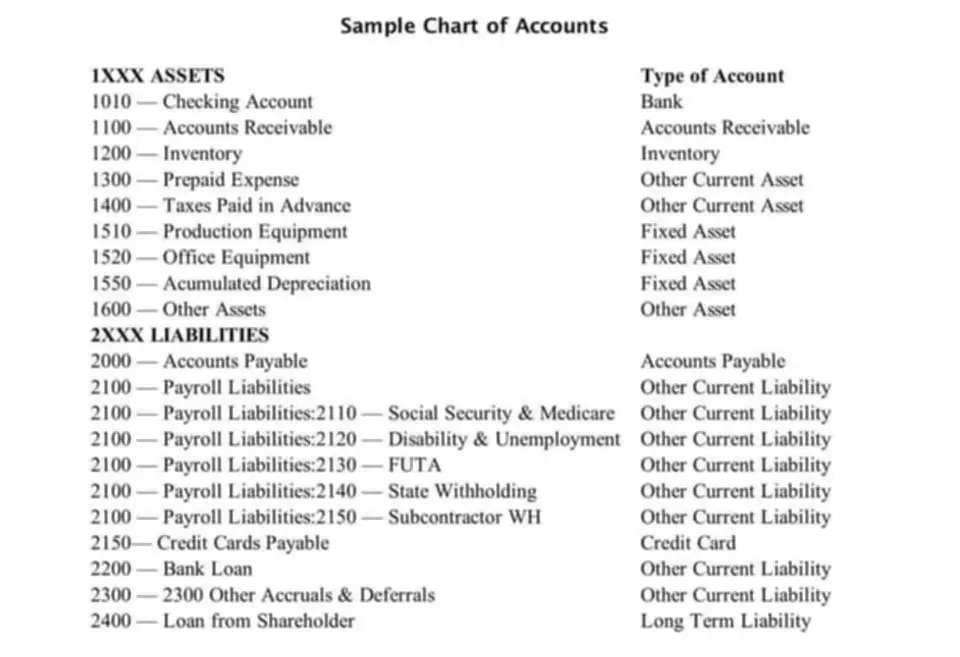

A startup needs to track all transactions. Most startup accounting also involves organizing separate ledgers for assets, liabilities, revenue, and expenses.

And don’t forget those phone bills, internet bills, and educational classes you took. These write-offs can be a great relief in offsetting the amount you owe. GAAP is a commonly used set of rules, regulations, standards, and procedures created by the Financial Accounting Standards Board (FASB) to develop financial reporting consistency across industries. But knowing how to manage your account efficiently might not be all that intuitive at first. More than just being good with the numbers, an accountant must also stick to best practices in their profession. In particular, you will want someone who is well versed in the Generally Accepted Accounting Principles (GAAP).

Ready to create your first business? Start your free trial of Shopify—no credit card required.

Proper accounting for your startup business can save you from being subjected to an IRS audit or an audit from your state taxing agency. Tax compliance is a complicated thing, and when businesses get audited, it’s usually because there are red flags in their tax returns that indicate potential issues. If you haven’t given much thought to startup accounting, you might feel overwhelmed looking at this list. However, most of these things are easy to maintain, and you can partner with a professional accountant to help you organize and optimize your records.

If startups bring in a ton of cash, this metric will help the business see if their finances are treading water or making a profit. Accrual basis accounting counts money and expenses when it is earned instead of received. This type of accounting is more involved but will give you a clearer outlook of the business’s future picture. If your startup is sprouting, this article will teach you all things bookkeeping and accounting. You will also learn about the benefits to your bottom line from understanding the business. Check out the following accounting software you could use to manage your books.

When To Outsource Your Accounting

In addition to maintaining copies of your tax returns, the following are other documents and records that the Internal Revenue Service asks businesses to retain. There are two potential accounting methods to choose from, each with its benefits. Your first step is to open a dedicated bank account for your business. It’s never wise to commingle your business accounting with your personal expenses.

Posted by adwords on 8th February 2022, under Bookkeeping

Dr. Kishanie Wijesinghe Little BDS

Dr. Kishanie Wijesinghe Little BDSDr. Kishanie Little is passionate about delivering excellent dentistry and dental restorations that are life-like and indistinguishable from natural teeth. She believes that restorations (fillings/crowns/veneers) should look beautiful – and that they should last. Dr. Little keeps abreast of new developments in restorative dentistry through post-graduate training.

Dr. Little is also an experienced Facial Aesthetistician, including Botulinum toxins (such as Botox) and Dermafillers. She appreciates how simple and subtle changes to smooth and relax muscles can “freshen” a face, to look younger.

In her personal time, she loves to cook, read, run, practice yoga and pilates, play a bad game of tennis and am now learning to play golf. She loves Art and Theatre and support the Tate Modern. She also enjoys writing and has a book in the works.